CMS has proposed several revisions to its reimbursement methodologies, which could have an adverse or favorable financial impact.

Evaluation & Management (E&M) Codes

Currently, reimbursement for an E&M code is tied to the level of the code (e.g., a physician will get substantially more reimbursement for a level 5 E&M than they would for a level 2 E&M). CMS is now proposing to pay the same amount for E&M levels 2, 3, 4 and 5. There are some positive sides to this change. The proposed changes to documentation requirements which accompany this change, could mean less burden for physicians. Also, if a physician’s utilization is skewed towards lower level E&M codes, they would now be paid more than if the current system remained.

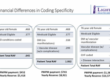

However, for those physicians who code high level E&Ms, this will result in a decrease in revenue. In a recent webinar given by Frank Cohen of Doctors Management, he used 2016 CMS E&M data to predict which specialties will be adversely and favorably affected by this proposed rule. His model showed that about half of the specialties would see an increase in revenue, and half would see a decrease. The specialties predicted to experience the greatest adverse financial impact are hospice and palliative care, neurology, hematology, neuropsychiatry, OBGYN, medical oncology, geriatric medicine, endocrinology and nephrology.

Compensation Models

Aside from the reimbursement received from CMS, the proposed changes to the E&M payment schedule could also impact physicians with compensation models tied to work RVUs. The proposed changes to the total RVUs will likely lead to changes to the work RVUs. This would then change physician compensation, either favorably or unfavorably, depending on the physician’s utilization of the various levels of E&M codes.

Another proposed change to reimbursement is an update in certain cases for modifier 25. CMS has proposed that when an E&M and procedure are performed in an office setting on the same day, coded with modifier 25, the lesser of the two charges will be reduced by 50%. An example would be if a patient visits an orthopedist for pain in their wrist. The orthopedist examines the patient’s wrist (E&M) and determines that an injection would be an appropriate plan of care and administers the injection that same day (procedure). The lesser of the two codes would then be reduced by 50%.

Pharmaceutical Reimbursement

Turning to Part B pharmaceutical reimbursement, CMS is proposing to decrease reimbursement for the drugs new to the market. These would be reimbursed at 103% of Wholesale Acquisition Cost (WAC), compared to the 106% being paid now. Once a drug has been on the market for some time, typically two quarters, there is sufficient Average Sales Price (ASP) data to utilize for determining reimbursement. At that point, CMS would pay 106% of ASP, and there has been no proposed change to this reimbursement for 2019.

The financial implications of CMS’ proposal have the potential to be significant. Stay tuned for more information as we get closer to the Final Rule.

Content retrieved from:

https://lighthousehealthcareadvisors.com/post/financial-impact-of-the-proposed-rule.